Power System Master Plan Update

Power Cell

Power Division

Ministry of Power, Energy & Mineral Resources

Asian Development Bank

TA No. 4379–BAN: Power Sector Development Program II Component B

Collaborating with:

Bangladesh Power Development Board Power Grid Company of Bangladesh Limited

In Association with: Bangladesh Engineering & Technological Services

June 2006

Contents

Section Page

Acronyms and Abbreviations................................................................................................ ix

Section 1 Executive Summary.......................................................................................... 1-1

1.1 Introduction............................................................................................................. 1-1

1.2 Overview of Power System Planning..................................................................... 1-1

1.3 Summary of Results................................................................................................ 1-3

1.3.1 Existing Power System (Section 2)................................................................. 1-3

1.3.2 Load Forecast (Section 3)............................................................................... 1-8

1.3.3 Fuel Supply (Section 4)................................................................................ 1-10

1.3.4 Generation and Transmission Expansion Options (Section 5)...................... 1-11

1.3.5 Generation Expansion Plan (Section 6)......................................................... 1-16

1.3.6 Transmission Expansion Plan (Section 7)..................................................... 1-25

1.3.7 Economic and Financial Analysis (Section 8)............................................... 1-25

1.4 Recommendations................................................................................................. 1-28

1.4.1 Eliminate Load Shedding.............................................................................. 1-28

1.4.2 Near-Term Strategy....................................................................................... 1-28

1.4.3 Assure Natural Gas Availability................................................................... 1-29

1.4.4 Reduce Uncertainty....................................................................................... 1-29

Section 2 Existing Power System..................................................................................... 2-1

2.1 Overview Of Existing Power System..................................................................... 2-1

2.2 Existing and Committed Generation Projects.......................................................... 2-3

2.3 Existing Transmission System and Committed projects........................................ 2-13

2.3.1 Existing Transmission System...................................................................... 2-13

2.3.2 Committed Transmission Projects................................................................. 2-13

Section 3 Load Forecast.................................................................................................... 3-1

3.1 Introduction............................................................................................................. 3-1

3.2 Load and GDP Analysis......................................................................................... 3-1

3.2.1 Historical Sales and Demand Data.................................................................. 3-1

3.2.2 Historical Net Peak Load................................................................................ 3-3

3.2.3 Load Shedding Data and Analysis.................................................................. 3-3

3.2.4 Distribution of Load by Region...................................................................... 3-4

3.2.5 Historical GDP Data....................................................................................... 3-5

3.2.6 GDP Growth Forecast.................................................................................... 3-6

3.2.7 Demand Side Management, Load Management, and Energy Efficiency......... 3-7

3.3 Forecasting Methodology..................................................................................... 3-10

3.3.1 Regression Analysis..................................................................................... 3-10

3.3.2 Energy Forecasting....................................................................................... 3-11

3.3.3 Peak Demand Forecasting............................................................................. 3-11

3.4 Forecasting Results............................................................................................... 3-12

3.4.1 Electricity Availability By 2020.................................................................... 3-20

3.5 Comparison of Forecasts...................................................................................... 3-20

3.6 Substation Load Forecast...................................................................................... 3-22

3.6.1 Reactive Demand.......................................................................................... 3-22

3.7 Company Load Forecast....................................................................................... 3-23

Section 4 Fuel Supply....................................................................................................... 4-1

Appendices A and B are contained in a separate volume

Table Page

Table 1-1 Generation Capacity by Region............................................................................... 1-6

Table 1-2 Existing Transmission Lines................................................................................... 1-7

Table 1-3 Existing 230/132 KV Transformers........................................................................ 1-7

Table 1-4 Net Energy Generation and Net Peak Load Forecasts............................................. 1-9

Table 1-5 Fuel Price Forecasts.............................................................................................. 1-11

Table 1-6 Generation Expansion Options............................................................................. 1-12

Table 1-7 Sites and Capacity Additions................................................................................ 1-15

Table 1-8 Base Case Unit Additions and System Reliability Indices.................................... 1-19

Table 1-9 Base Case System Costs....................................................................................... 1-20

Table 2-1 Generation Capacity by Region............................................................................... 2-3

Table 2-2 Primary Energy Resources for Existing and Committed Capacity........................... 2-4

Table 2-3 Existing and Committed Generation........................................................................ 2-7

Table 2-4 Rehabilitation Projects........................................................................................... 2-11

Table 2-5 Status of Committed Generation Projects.............................................................. 2-12

Table 2-6 Existing Transmission Lines................................................................................. 2-14

Table 2-7 Existing 230/132 KV Transformers...................................................................... 2-14

Table 2-8 Committed Transmission Projects......................................................................... 2-14

Table 3-1 Historical Sales and Loss Data by Utility................................................................ 3-2

Table 3-2 Net Peak Load Values............................................................................................. 3-3

Table 3-3 Peak Load Analysis................................................................................................ 3-4

Table 3-4 Load Shedding Analysis......................................................................................... 3-4

Table 3-5 Historical Electricity Requirements by Region and Distribution Factors................. 3-5

Table 3-6 Historical GDP and Growth Rates, Constant 1995-6 Taka..................................... 3-6

Table 3-7 GDP Projections and Growth Rates, Constant 1995-6 Taka.................................. 3-7

Table 3-8 Net Energy Generation and Net Peak Load Forecasts........................................... 3-13

Table 3-9 Yearly and Average Growth Rates for Energy and Peak Load............................. 3-13

Table 3-10 Base Case Forecast Net Energy Generation and Net Peak Load by Region........ 3-16

Table 3-11 High Case Forecast Net Energy Generation and Net Peak Load by Region........ 3-17

Table 3-12 Low Case Forecast Net Energy Generation and Net Peak Load by Region........ 3-18

Table 3-13 Forecast Distribution and Trans Losses and Base Case Sales by Region........... 3-19

Table 3-14 Comparison of Forecasts.................................................................................... 3-21

Table 3-15 Demand Forecast by Company........................................................................... 3-24

Table 4-1 Natural Gas Reserves of Bangladesh...................................................................... 4-2

Table 4-2 Natural Gas Production (FY2003).......................................................................... 4-3

Table 4-3 Gas Consumption in FY2003................................................................................ 4-4

Table 4-4 Production Augmentation Projects (FY2005-2010)............................................... 4-4

Table 4-5 Projected Maximum Gas Demand (FY2005-2010)................................................ 4-5

Table 4-6 Gas and Coal Requirement During 2005-2025 (Sufficient Gas Scenario).............. 4-5

Table 4-7 Estimated Coal Reserves......................................................................................... 4-7

Table 4-8 Phulbari Mine Development Timetable................................................................... 4-8

Table 4-9 Historical Fuel Prices.............................................................................................. 4-8

Table 4-10 Fuel Price Forecast.............................................................................................. 4-14

Table 5-1 Generation Expansion Options............................................................................... 5-4

Table 5-2 Summary of Sites and Capacity Additions for Base Case.................................... 5-14

Table 6-1 Cost of Production – Diesel Backup Generation..................................................... 6-5

Table 6-2 Scenarios Evaluated.............................................................................................. 6-10

Table 6-3 Screening Analysis Options.................................................................................. 6-14

Table 6-4 Base Case Unit Additions and System Reliability Indices.................................... 6-24

Table 6-5 Base Case System Costs....................................................................................... 6-25

Table 6-6 Conversion Factors in Calculations of Fuel Usage............................................... 6-27

Table 6-7 Base Case Fuel Use.............................................................................................. 6-28

Table 6-8 Sites and Capacity Addition.................................................................................. 6-29

Table 6-9 High Demand Scenario Unit Additions and System Reliability Indices................ 6-31

Table 6-10 Low Demand Scenario Unit Additions and System Reliability Indices.............. 6-32

Table 6-11 Limited Gas Scenario Unit Additions and System Reliability Indices................. 6-34

Table 6-12 Limited Gas Scenario System Costs................................................................... 6-35

Table 6-13 Limited Gas Scenario Fuel Requirements........................................................... 6-36

Table 6-14 Limited Gas – Early Coal Scenario Unit Additions and System Reliability Indices

...................................................................................................................................... 6-37

Table 6-15 Limited Gas – Early Coal Scenario System Costs.............................................. 6-38

Table 6-16 Limited Gas – Early Coal Scenario Fuel Requirements...................................... 6-39

Table 6-17 Fuel Security Scenario Unit Additions and System Reliability Indices.............. 6-40

Table 6-18 Fuel Security Scenario System Costs................................................................. 6-41

Table 6-19 Fuel Security Scenario Fuel Requirements......................................................... 6-42

Table 6-20 Unit Additions in Coal Scenarios and Base Case............................................... 6-43

Table 6-21 Total Costs by Cost Category in Coal Scenarios and Base Case........................ 6-44

Table 6-22 Study Period Natural Gas and Coal Use in Coal Scenarios and Base Case........ 6-44

Table 6-23 High Disc Rate Scenario Unit Additions and System Reliability Indices........... 6-46

Table 6-24 Low Disc Rate Scenario Unit Additions and System Reliability Indices........... 6-47

Table 6-25 Discount Rate Scenarios Cost Comparison........................................................ 6-47

Table 6-26 Cost of ENS Scenarios Cost Comparison........................................................... 6-49

Table 6-27 No LOLP Criterion Scenarios Cost Comparison................................................ 6-51

Table 6-28 New 500 MW Unit - Cost Savings..................................................................... 6-53

Table 6-29 New 500 MW Unit - Value Summary................................................................ 6-53

Table 6-30 New 1,000 MW Interconnection - Cost Savings................................................ 6-55

Table 6-31 New 1,000 MW Interconnection - Value Summary............................................ 6-56

Table 7-1 Summary of Transmission Planning Criteria.......................................................... 7-4

Table 7-2 Summary Generation Dispatch for All Cases....................................................... 7-10

Table 7-3 Reactive Compensation by Region for 2025......................................................... 7-15

Table 7-4 Generation Load and Losses by Region – Plan A................................................. 7-15

Table 7-5 Short Circuit Currents for Plan A at 2025............................................................. 7-16

Table 7-6 Typical Time Sequence for Dynamic Simulations................................................. 7-17

Table 7-7 Three-Phase Faults................................................................................................ 7-18

Table 7-8 Summary of Transmission Lines for 2025 Transmission Plan A......................... 7-19

Table 7-9 Summary of Transformers for 2025 Transmission Plan A................................... 7-20

Table 7-10 Summary of 2025 Transmission Plan B............................................................. 7-22

Table 7-11 Capacitors 100 MVARS and Larger for Horizon Year 2025............................. 7-22

Table 7-12 Summary Cost Comparison for Plan A and B.................................................... 7-23

Table 7-13 Cost of Components for 2021-2025................................................................... 7-24

Table 7-14 Reactive Compensation by Region for 2010....................................................... 7-30

Table 7-15 Generation Load and Losses by Region 2010..................................................... 7-30

Table 7-16 List of Transmission Lines for 2010................................................................... 7-31

Table 7-17 List of Transformers for 2010............................................................................. 7-31

Table 7-18 Capacitors for 2010 Larger Than 25 MVAR...................................................... 7-32

Table 7-19 Cost of Components for 2005-2010................................................................... 7-33

Table 7-20 Reactive Compensation by Region for 2015....................................................... 7-35

Table 7-21 Generation Load and Losses by Region 2015..................................................... 7-36

Table 7-22 Transmission Lines for Period 2010 to 2015...................................................... 7-36

Table 7-23 Transformers for Period 2010 to 2015................................................................ 7-37

Table 7-24 Capacitors for Period 2010 to 2015.................................................................... 7-37

Table 7-25 Cost of Components for 2015............................................................................. 7-38

Table 7-26 Reactive Compensation by Region for 2020....................................................... 7-41

Table 7-27 Generation Load and Losses by Region 2020..................................................... 7-41

Table 7-28 Transmission Lines for Period 2015 to 2020...................................................... 7-42

Table 7-29 Transformers for Period 2015 to 2020................................................................ 7-43

Table 7-30 List of Capacitors Larger Than 100 MVAR for Year 2020................................ 7-43

Table 7-31 Cost of Components for 2020............................................................................. 7-43

Table 8-1 Unit Class Capacity Factors.................................................................................... 8-5

Table 8-2 Resource Plan Additions for Load Growth Scenarios............................................ 8-7

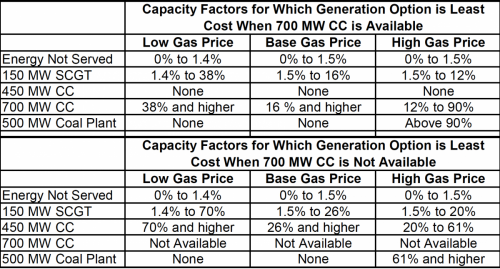

Table 8-3 Least Cost Options at Different Gas Prices............................................................. 8-9

Table 8-4 Summary of COENS Scenarios............................................................................ 8-10

Table 8-5 Fuel Price Scenarios.............................................................................................. 8-15

Table 8-6 Overall Summary of Cash Flows.......................................................................... 8-15

Table 8-7 Generation Investments......................................................................................... 8-16

Table 8-8 Transmission Investments..................................................................................... 8-17

Table 8-9 Investment Requirements July 2005 through June 2010....................................... 8-18

Figure Page

Figure 1-1 Map of Existing System........................................................................................ 1-5

Figure 1-2 Base, High, and Low Demand Forecasts.............................................................. 1-9

Figure 1-3 All Technologies and Least Cost Curve.............................................................. 1-18

Figure 1-4 Base Case Fuel Use............................................................................................. 1-21

Figure 1-5 Comparison of Costs and Natural Gas Use for Demand Growth Cases............. 1-22

Figure 1-6 Comparison of Total Costs, Base Case vs. Limited Gas Case............................. 1-22

Figure 1-7 Fuel Use in Limited Gas Case vs. Base Case Natural Gas Use........................... 1-23

Figure 2-1 Map of Existing System........................................................................................ 2-2

Figure 3-1 Historical GDP and Net Energy Generation Correlation Graph.......................... 3-11

Figure 3-2 Load Factor Analysis.......................................................................................... 3-12

Figure 3-3 Base Case Energy and Peak Load Forecasts....................................................... 3-14

Figure 3-4 High and Low Case Energy and Peak Load Forecasts........................................ 3-14

Figure 3-5 Comparison of Forecasts..................................................................................... 3-21

Figure 6-1 Cost Representation for Screening Analysis Method.......................................... 6-12

Figure 6-2 Base Load Technologies...................................................................................... 6-15

Figure 6-3 Peaking Technologies.......................................................................................... 6-16

Figure 6-4 Peaking Technologies vs. COENS...................................................................... 6-17

Figure 6-5 All Technologies and Least Cost Curve.............................................................. 6-18

Figure 6-6 Higher Gas Price................................................................................................. 6-19

Figure 6-7 Lower Gas Price.................................................................................................. 6-19

Figure 6-8 Breakeven Coal Price.......................................................................................... 6-20

Figure 6-9 Base Case Fuel Use............................................................................................. 6-27

Figure 6-10 Demand Scenarios - Cost and Fuel Use Comparison........................................ 6-33

Figure 6-11 Total Costs in Coal Scenarios and Base Case.................................................... 6-43

Figure 6-12 Natural Gas and Coal Use in Coal Scenarios and Base Case............................. 6-45

Figure 6-13 Discount Rate Scenarios - Total Installed Capacity........................................... 6-45

Figure 6-14 Cost of ENS Scenarios - Total Installed Capacity.............................................. 6-48

Figure 6-15 Cost of ENS Scenarios - LOLP........................................................................ 6-49

Figure 6-16 No LOLP Scenarios - Total Installed Capacity and Reserve Margins............... 6-50

Figure 6-17 No LOLP Scenarios – Reliability Statistics....................................................... 6-51

Figure 7-1 Horizon Year Development Process..................................................................... 7-7

Figure 7-2 One-Line Diagram of Plan A for Year 2025....................................................... 7-12

Figure 7-3 Stability Plot of NCF-01..................................................................................... 7-19

Figure 7-4 Stability Plot of NCF-04..................................................................................... 7-19

Figure 7-5 One-Line Diagram of Plan A for Year 2010....................................................... 7-27

Figure 7-6 One-Line Diagram of Plan A for Year 2015....................................................... 7-34

Figure 7-7 One-Line Diagram of Plan A for Year 2020....................................................... 7-39

Figure 8-1 Least Cost Curve – Base Case............................................................................... 8-2

Figure 8-2 Comparison of Peak Load Technologies.............................................................. 8-3

Figure 8-3 Energy Not Served and Equivalent Capacity Factor.............................................. 8-5

Figure 8-4 Least Cost Curve – High Gas Prices..................................................................... 8-8

Figure 8-5 Least Cost Curve – Low Gas Prices...................................................................... 8-9

Figure 8-6 LOLP Expectation for Cost of ENS Cases.......................................................... 8-11

Acronyms and Abbreviations

AC | Alternating Current |

ADB | Asian Development Bank |

AECB | Asia Energy Corporation Bangladesh |

BAPEX | Bangladesh Petroleum Exploration and Production Company Limited |

BDT | Bangladesh Taka |

BETS | Bangladesh Engineering & Technological Services |

BOGMC | Bangladesh Oil, Gas, and Mineral Corporation (Petrobangla) |

BPDB | Bangladesh Power Development Board |

BSCF | Billion Standard Cubic Feet |

CC | Combined cycle |

COENS | Cost of energy not served |

DC | Direct Current |

DESA | Dhaka Electric Supply Authority |

DESCO | Dhaka Electric Supply Company Limited |

EIA | Energy Information Agency |

ENS | Energy Not Served |

FY | Fiscal Year |

GDP | Gross Domestic Product |

GJ | Gigajoule |

GOB | Government of Bangladesh |

GSB | Geological Survey of Bangladesh |

GWH | Gigawatt Hour |

IAEA | International Atomic Energy Agency |

IDC | Interest During Construction |

IOC | International Oil Company |

IPP | Independent Power Producer |

KA | Kiloampere |

KCAL | Kilocalorie |

KJ | Kilojoule |

KM | Kilometer |

KVA | Kilovolt Ampere |

KVAR | Kilovolt Ampere Reactive |

KW | Kilowatt |

KWH | Kilowatt Hour |

LOLP | Loss of Load Probability |

MJ | Megajoule |

MMSCFD | Million Standard Cubic Feet per Day |

MVA | Megavolt Ampere |

MVAR | Megavolt Ampere Reactive |

MW | Megawatt |

MWH | Megawatt Hour |

NPV | Net Present Value |

OPEC | Organization of Petroleum Exporting Countries |

ORNL | Oak Ridge National Laboratory |

O&M | Operation and Maintenance |

PBS | Palli Budyet Samity (a form of rural electric cooperative) |

PCP | Project Concept Paper |

PGCB | Power Gird Company of Bangladesh Limited |

PMU | Project Management Unit |

PP | Project Pro-forma |

PSC | Production Sharing Contract |

PSMP | Power Sector Master Plan |

REB | Rural Electrification Board |

SCF | Standard Cubic Foot |

SCGT | Simple Cycle Gas Turbine |

TA | Technical Assistance |

TSCF | Trillion Standard Cubic Feet |

TMT | Thousand Metric Tonnes |

TOR | Terms of Reference |

TVA | Tennessee Valley Authority |

UK | United Kingdom |

US | United States |

WASP | Wien Automatic System Planning package |

WZPDCL | West Zone Power Distribution Company Limited |

Section 1 Executive Summary

1.1 INTRODUCTION

Nexant, Inc. has been retained by the Asian Development Bank (ADB), under Contract No. COCS/05-158, to provide consulting services for the Power Sector Development Program II study. The objective of this Technical Assistance (TA) assignment is to assist the Government of Bangladesh in preparing the Power Sector Development Program II and to support the policy reform and further restructuring of the power sector. A key part (Component B) of the TA is to develop a Power System Master Plan (PSMP) Update to the year 2025. This effort completely revises the 1995 Power System Master Plan, the most recent previous update.

Nexant assisted Bangladesh Power Development Board, Power Gird Company of Bangladesh Limited, and Power Cell in developing this PSMP Update.

Section 1.2 elaborates on the objectives of the PSMP update and provides an overview of power system planning in general. Section 1.3 summarizes the results of the PSMP Update. Section 1.4 offers our recommendations. The rest of this report is organized as shown below, generally following the content and sequence outlined in Section 1.2.

- Section 2 provides an overview of the existing generation and transmission systems.

- Section 3 presents our load forecast.

- Section 4 addresses energy resources, especially fuel supply. .

- Section 5 discusses generation and transmission expansion options and potential generating plant sites.

- Section 6 provides the generation expansion plan.

- Section 7 presents the transmission expansion plan.

- Section 8 discusses economic analysis and financial projections for the proposed development plan.

1.2 OVERVIEW OF POWER SYSTEM PLANNING

Power system planning in Bangladesh must be consistent with the Government of Bangladesh’s (GOB’s) objectives for the power sector. The GOB’s 1994 paper “Power Sector Reforms in Bangladesh” outlined a reform process focusing on institutional issues. The 2000 Vision and Policy Statement for the Power Sector Reforms elaborated on institutional issues for the power sector. It also gave specific direction on issues related to the physical planning of the power system, of which the most relevant for power system planning are:

- Make electricity available for all by 2020

− The load forecast and generation and transmission expansion plans need to account for this.

- Ensure reliable and quality supply of electricity

− An appropriate level of reliability is a specific target of the planning process.

- Increase the sector's efficiency

− New power plants are the most efficient, cost effective of their type. The planning process adds enough generation and transmission to provide cost- effective reliability.

- Develop demand management and energy efficiency measures

− The load forecast needs to account for this.

- Develop alternative/renewable energy sources

− The new generation options need to address this.

- Base new generation on a least cost expansion plan

− This is the basis for the generation expansion planning procedures.

- Expand transmission in balance with the generation capacity

− This is the basis for the transmission expansion planning procedures.

In summary, the planning process achieves these objectives if it is done comprehensively and based on least cost principles. One fundamental trade-off is between cost and reliability. The planning process undertaken in this study quantifies the value of reliability. It balances the benefit of increased reliability against the cost of achieving it, and adds new generation until that balance is achieved.

The planning process proceeds roughly in the sequence shown below.

− Planning criteria, description of the existing system, fuel supply and costs, economic data, existing plant cost, performance, rehabilitation, and retirements, expansion options and sites

− Analysis of historical data, approach, energy forecast, capacity forecast, regional demand, substation loads

- Step 3. Fuel supply forecast

− Availability and costs of different fuels

- Step 4. Generation expansion plan

− Prepare inputs; conduct screening analysis; analyze thousands of alternative plans to get least-cost option that meets criteria; summarize key outputs such as type, fuel, timing, and size of new generating units, the output and fuel use of all generating units, the costs of all cost categories, reliability statistics, etc.

− Identify sites for the generating plants and place specific new plants on those sites in specific years for transmission planning purposes.

- Step 6. Transmission expansion plan

− Prepare inputs; establish pattern of generation for each study year; conduct load flows, stability, short circuit, losses, and cost analyses; identify transmission plan that best meets planning and cost objectives; summarize the type, timing, size, of new transmission facilities

The completion of the generation and transmission expansion plans typically represents the end of the power system planning process. The Terms of Reference for Component B include separate tasks for an environmental assessment and a financial and economic analysis. These might be considered to be the beginning of the implementation process that leads to project design, construction, and operation. Section 8 of this report addresses the financial and economic assessment. A separate document, Volume 3 of the Component C report, provides among other things the environmental assessment.

1.3 SUMMARY OF RESULTS

The data and results in this report are generally expressed in terms of fiscal years, which for the Bangladesh power sector organizations end in on 30 June. For example, the fiscal year 2003 runs from 1 July 2002 to 30 June 2003.

1.3.1 Existing Power System (Section 2)

1.3.1.1 Overview of Existing Power System

Demand in Bangladesh is concentrated in the Dhaka region, which had 47% of the national total of 3,952 MW (including estimated load shedding) in 2004. Significant load shedding due primarily to lack of generation occurred in each of the historical years reviewed, reaching 461 MW at time of peak in 2004.

Natural gas from fields in the eastern part of the country fuels the vast majority of the existing power plants.

Placing power plants close to Dhaka minimized transmission costs and losses, and helped maintain voltages. Dhaka is also relatively accessible from the eastern gas fields. Thus in general terms the generation system today consists of multiple plants with 61% of national capacity near Dhaka, with smaller plants near the gas fields or other load centers.

The highest voltage transmission system consists of a 230 KV loop around Dhaka with radial extension to the other regions. The 132 KV system initially extended radially from Dhaka to the other regions, but now includes loops ringing Dhaka and Chittagong, and larger loops in the Southern, Western, and Northern regions.

Figure 1-1 provides a map of the existing generation and transmission systems that also shows the main natural gas fields.

1.3.1.2 Existing and Committed Generation Projects

Table 1-1 summarizes generation by region. As of June 2004 existing net capacity is 4,120 MW. We include “committed” generation of 2,845 MW as well as existing plants in the planning process. These are plants that are not yet operational, but that are far enough along in the process of approving, financing, and building that it is highly likely that they will be built and become operational. In other words, these are plants that are not subject to being displaced by new units that the generation planning process may identify.

Delays in completing the rehabilitation projects or especially the committed projects will reduce the amount of generation available to meet load in the first few years of the planning period. Thus is especially important to complete these projects, because in many cases there is not enough time to replace their generation with new plants. The current status indicates that most of the projects are progressing towards completion on or close to schedule.

However, in some cases funding has not been completed. Many of the projects rely on GOB funding, for which there may be competing needs.

Figure 1-1 Map of Existing System

Table 1-1 Generation Capacity by Region

Region | Dhaka | Central | Southern | Northern | Western | National |

Number of Existing Units June 2004 | 23 | 11 | 4 | 4 | 16 | 58 |

Existing Generation June 2004, Derated Net MW | 2,506 | 345 | 605 | 260 | 404 | 4,120 |

% of National Total MW | 61% | 8% | 15% | 6% | 10% | 100% |

MW/Unit | 109 | 31 | 151 | 65 | 25 | 71 |

Number of Committed Units | 8 | 3 | 2 | 5 | 1 | 19 |

Committed Generation to 2009, Derated Net MW | 1,342 | 257 | 199 | 850 | 197 | 2,845 |

% of National Total MW | 47% | 9% | 7% | 30% | 7% | 100% |

Number of Existing and Committed Units | 31 | 14 | 6 | 9 | 17 | 77 |

Total Existing and Committed, Derated Net MW | 3,848 | 602 | 804 | 1,110 | 601 | 6,965 |

% of National Total MW | 55% | 9% | 12% | 16% | 9% | 100% |

1.3.1.3 Existing Transmission System and Committed Projects

Figure 1-1 shows PGCB’s transmission system. This figure includes all the existing 230 KV and 132 KV transmission lines as solid lines and planned and under construction facilities as dashed lines.

The highest voltage level of PGCB’s transmission system is 230 KV with transmission lines structured as a 230 KV loop around Dhaka with radial extension to the western part of Bangladesh and the Southern Region in the Chittagong area. The 132 KV system extends radially from Dhaka to the Central and Southern regions. Similarly, the Northern and Western regions in the western part of the country are interconnected through 132 KV lines.

Table 1-2 summarizes the existing transmission lines. Table 1-3 summarizes the 230/132 KV transformers.

The paragraphs above summarize the structure of the present transmission system. This system currently experiences problems of low voltages, not only in the Dhaka area, but also in the other regions of the country. PGCB is well aware of these problems and has taken steps to initiate a program of reactive compensation by way of adding shunt capacitors at different locations of the transmission system.

Table 1-2 Existing Transmission Lines

Region | Voltage, Nominal kV | Length, Circuit-Km |

Southern | 230 | 623 |

| 132 | 1326 |

Dhaka | 230 | 673 |

| 132 | 597 |

Central | 132 | 804 |

Western | 230 | 140 |

| 132 | 990 |

Northern | 132 | 1151 |

Total | 230 | 1436 |

| 132 | 4868 |

Table 1-3 Existing 230/132 KV Transformers

Region | Capacity (MVA) |

Southern | 675 |

Dhaka | 2800 |

Northern | 450 |

Total | 3925 |

Currently there are several transmission projects under construction. A second 230 KV line that will interconnect the eastern and western portions of the country is among the most important, contributing to a significant improvement of PGCB’s transmission system reliability. This line will go through the Jamuna Bridge from the Ashuganj substation in the eastern part of the country to the Sirajganj substation in the west. Another 230 KV line is under construction from Barapukuria in the upper part of the Northern region of Bangladesh to Sirajganj near the Jamuna River. Similarly a 230 KV line is under construction from Ishurdi in the northern region to Khulna in the Western region of Bangladesh.

There are several committed projects in the Dhaka area. One of them is a committed 400 kV double circuit line that will go from the area around the existing Meghnaghat 230 kV substation to the existing Aminbazar 230 kV substation and it is expected to become operational by 2010. This line though insulated at 400 kV will initially be operated at 230 kV. It is expected that this line will start operation at 400 kV in the year 2015. Another committed project is a transmission line from the existing Aminbazar 230 kV substation to a new Old Airport 230 kV substation. This line is a double circuit transmission facility that will assist in supporting the load growth in the western part of Dhaka. There is also a committed double circuit transmission facility to go from Ullon 132 kV substation to the Rampura 132 kV substation.

There are several committed projects in other regions of the country as well. In the Western region two double circuit 132 kV lines are expected to be built from the 132 kV Jhenida substation to new 132 kV substations at Magura and Chuadanga. In the Northern region two double circuit 132 kV lines are expected to be built, one from the Naogaon 132 kV substation to a new 132 kV substation at Joypurhat and another from the Thakurgaon 132 kV substation to a new 132 kV substation in Panchaghar.

1.3.2 Load Forecast (Section 3)

Over the last ten years net energy demand growth at an average compound annual rate of 8.1% has accompanied gross domestic product (GDP) growth at an average of 5.1%.

Electricity demand has grown at about the same rate in all regions. Load factor has been steady but slightly increasing. Load shedding has been a problem throughout the period. The Rural Electrification Board (REB), and then DESCO, have picked up substantial parts of what was previously DESA and BPDB loads. Distribution losses have dropped from an average of 30% in 1994 to 21% in 2004. Transmission losses fell from 4.7% to 3.5% during the same period.

The demand forecast is based on the excellent historical correlation of electricity demand with GDP, and three forecasts of GDP growth through 2025. The Base Case uses GDP figures whose compound average annual growth rate is 5.2%. The Low Case GDP figures average annual rate is 4.5%. The High Case is based on a GOB forecast with an annual average rate of 8.0%.

These GDP growth rates produce net energy demand growth rates to 2025 of 7.9% for the Base Case, 6.7% for the Low Case, and 12.0% for the High Case. Figure 1-2 and Table 1-4 present these forecasts in graphical and tabular format. These are grid input values, referred to the high voltage side of power plant main transformers. We have assumed that transmission and distribution losses continue to fall. For transmission, they drop to 3.0% by 2018. Distribution losses drop to 10% by 2019. In our approach the impact of these loss reductions is to increase forecast sales, which then grow slightly faster than net energy generation in the future as they have in the past. In the Base Case sales grow at an annual average 8.5% compared to 7.9% for net energy generation.

We compared this study’s forecast with the forecast developed for the 1995 Power System Master Plan (1995 PSMP), the recent forecast developed as part of the current ADB Gas Development Project, and the recent forecast developed as part of the 2005 Gas Sector Master Plan.. All four forecasts are very close; the ADB Gas study would be even closer if the gross generation figures were reduced to correspond to the net values used in the other three studies. This confirms earlier observations that 1995 PSMP load forecast was very accurate, and also demonstrates that the calculations for natural gas use in the power sector in the ADB Gas study and in the 2005 Gas Sector Master Plan study are based on an electricity generation forecast similar to the Base Case of this study.

Based on the regional distribution of demand reduced to account for transmission losses, we developed demand forecasts for each transmission substation expected to be in place by 2010. Based on our analysis of historical trends, we forecast that demand would grow at the same rate in each region as nationally. We did not constrain individual substations to grow at this rate. We did require that the total substation demand in each region equal the forecast regional demand. Individual substations in a region were assigned higher or lower growth rates based on PGCB’s view of likely differences in growth rates in different areas.

Consistent with a review of 2005 data and also based on discussions with BPDB and PGCB, this study forecasts reactive demand at each transmission substation based on a power factor of 90% for the transmission analysis study years 2010, 2015, 2020,and 2025.

| Base Case | High Case | Low Case | Projected Load Factor | Fiscal Year | Net Generation (GWh) | Net Peak Load (MW) | Net Generation (GWh) | Net Peak Load (MW) | Net Generation (GWh) | Net Peak Load (MW) | 2005 | 21,964 | 4,308 | 22,336 | 4,381 | 21,964 | 4,308 | 58.2% | 2006 | 23,945 | 4,693 | 24,692 | 4,839 | 23,611 | 4,627 | 58.2% | 2007 | 26,106 | 5,112 | 27,297 | 5,345 | 25,382 | 4,970 | 58.3% | 2008 | 28,461 | 5,569 | 30,177 | 5,904 | 27,286 | 5,339 | 58.3% | 2009 | 31,028 | 6,066 | 33,592 | 6,567 | 29,333 | 5,734 | 58.4% | 2010 | 33,828 | 6,608 | 37,652 | 7,355 | 31,533 | 6,160 | 58.4% | 2011 | 36,622 | 7,148 | 42,202 | 8,237 | 33,659 | 6,569 | 58.5% | 2012 | 39,647 | 7,732 | 47,627 | 9,288 | 35,928 | 7,007 | 58.5% | 2013 | 42,922 | 8,364 | 53,749 | 10,473 | 38,351 | 7,473 | 58.6% | 2014 | 46,467 | 9,047 | 60,659 | 11,810 | 40,937 | 7,970 | 58.6% | 2015 | 50,306 | 9,786 | 68,924 | 13,408 | 43,697 | 8,501 | 58.7% | 2016 | 54,079 | 10,512 | 78,316 | 15,223 | 46,643 | 9,066 | 58.7% | 2017 | 58,135 | 11,291 | 88,384 | 17,166 | 49,788 | 9,670 | 58.8% | 2018 | 62,496 | 12,128 | 99,746 | 19,357 | 53,145 | 10,313 | 58.8% | 2019 | 67,183 | 13,027 | 112,568 | 21,827 | 56,728 | 11,000 | 58.9% | 2020 | 72,222 | 13,993 | 126,172 | 24,445 | 60,553 | 11,732 | 58.9% | 2021 | 77,092 | 14,924 | 141,419 | 27,377 | 64,178 | 12,424 | 59.0% | 2022 | 82,290 | 15,917 | 158,510 | 30,661 | 68,020 | 13,157 | 59.0% | 2023 | 87,839 | 16,977 | 176,448 | 34,103 | 72,092 | 13,934 | 59.1% | 2024 | 93,761 | 18,107 | 196,415 | 37,931 | 76,408 | 14,756 | 59.1% | 2025 | 100,083 | 19,312 | 217,137 | 41,899 | 80,982 | 15,626 | 59.2% |

|

|

Figure 1-2 Base, High, and Low Demand Forecasts Table 1-4 Net Energy Generation and Net Peak Load Forecasts

1.3.3 Fuel Supply (Section 4)

Presently, natural gas is the only significant source of commercial energy in Bangladesh. About 85% of the power generation capacity in the country is gas based, 10% is imported oil based and 5% hydro. About 90% of electrical energy is generated by natural gas. Barapukuria Coal Mine in the north-west region of Bangladesh will supply coal to BPDB's first coal based 2x125 MW power plant, now under construction, by FY2006. There are also very good prospects of extraction of coal from a nearby coal deposit at Phulbari, and possibly elsewhere in the region.

Bangladesh Oil, Gas and Mineral Corporation (BOGMC, also known as Petrobangla) is the state-owned monopoly supplier of power plant fuels and is responsible for most fuels activity in Bangladesh. Petrobangla is under the administrative control of the Energy and Mineral Resources Division of the Ministry of Power, Energy and Mineral Resources.

Present gas reserves and production are adequate to serve the existing power system. It is highly probable that additional reserves could be developed to serve the needs of the power plants projected in the Master Plan. It is also likely that substantial coal could be developed in the area of current coal development. A planned 100 MW expansion of the existing hydro plant is the only substantial additional hydro feasible in the country. Imported coal or petroleum products are the other main options for fuel supply.

We base our fuel price forecasts on world market prices for petroleum liquids and coal. We base the forecast on an opportunity cost approach for natural gas, pricing it at 75% of the forecast price of heavy fuel oil, on an equivalent GJ basis. We understand that some of Petrobangla’s Production Sharing Contracts use 75% of a fuel oil benchmark as the key part of the calculation of price. The source data are crude oil and coal price forecasts from the US Energy Information Agency’s (EIA’s) Annual Energy Report 2005. EIA characterizes its forecasts as being of world market prices, in other words not specific to just the US. Both coal and especially oil are traded extensively in world markets. Thus prices in any open market situation should relate to their world market prices.

Table 1-5 provides the resulting prices, levelized in constant dollars over 2005 - 2025. We estimate fuel oil prices to be 75% of crude oil prices. This is based on historical data for the ratio of fuel oil price to crude oil price in dollars per GJ.

A market for domestic coal may develop in Bangladesh, given that several fields have been identified and more are possible. However, no realistic market exists today, so we must estimate prices using another approach. The key factor in the domestic prices shown in Table 1-5 is establishing the domestic fuel price at 80% of the price of imported coal, on a $/ton basis. The following concepts led us to this approach.

- Because coal is a world market product, domestic coal will have to compete with imported coal to supply power plants. Unless it is subsidized or protected from competition, it should cost no more than imported coal.

- If coal could be produced for much less than 80% as much as the cost of imported coal, it might well be economic to export it rather than use it domestically. In other words the world market price would influence the price of domestic coal regardless of its cost of production, unless the coal facility were required to subsidize other activities.

- The cost of coal, and to some extent its price, will vary substantially among mines, so no single price can be accurate for all mines. We understand that the Phulbari Coal Project may be able to supply its coal for less than the estimated forecast cost of imported coal, whereas the cost of coal from the Barapukuria Coal Mine may be higher.

Table 1-5 Fuel Price Forecasts

Fuel | Units | 2005 | 2010 | 2015 | 2020 | 2025 | | Level- ized | | Levelized in US cents per million Kcal |

Crude Oil Price (2003 US$) 1 | $/BBL | 33.99 | 25.00 | 26.75 | 28.50 | 30.31 | | 28.23 | |

Crude Oil price (2005 US$) | $/GJ | 6.47 | 4.76 | 5.09 | 5.42 | 5.77 | | 5.37 | | |

Heavy Fuel Oil Price 2 | $/GJ | 4.85 | 3.57 | 3.82 | 4.07 | 4.33 | | 4.03 | | 1686 |

High Sulfur Diesel 3 | $/GJ | 7.44 | 5.47 | 5.85 | 6.24 | 6.63 | | 6.18 | | 2585 |

Natural Gas Price 4 | $/GJ | 3.64 | 2.68 | 2.86 | 3.05 | 3.24 | | 3.02 | | 1265 |

Imported Coal 5 | $/Ton | 41.33 | 39.29 | 37.40 | 37.20 | 36.06 | | 39.56 | | |

Imported coal incl. transport | $/Ton | 56.45 | 54.28 | 52.28 | 52.07 | 50.85 | | 54.72 | | |

Imported Coal | $/GJ | 2.26 | 2.17 | 2.09 | 2.08 | 2.03 | | 2.19 | | 916 |

Domestic coal 6 | $/Ton | 45.16 | 43.43 | 41.82 | 41.66 | 40.68 | | 43.78 | | |

Domestic coal | $/GJ | 1.96 | 1.89 | 1.82 | 1.81 | 1.77 | | 1.90 | | 797 |

Notes

1. EIA 2005 Energy Outlook (price at refineries)

2. Fuel oil price is 0.75 of the forecast crude oil price.

3. LS diesel 1.20, and high sulfur diesel 1.15 for fuel oil price

4. Natural gas price is 0.75 of estimated fuel oil price

5. EIA 2005 Energy Outlook (exported price FAS of US coal)

6. Assumes 80% of Imported coal cost in $/Ton

1.3.4 Generation and Transmission Expansion Options (Section 5)

1.3.4.1 Generation

Fuel availability and cost drive the selection of generation options. Bangladesh has substantial proven reserves of natural gas and some proven reserves of coal. Both are available at reasonable cost. There is reason to expect that more natural gas and coal reserves will be discovered as exploration continues.

Bangladesh’s limited hydro potential will have been completely developed when the 100 MW extension of the existing Karnafuli plant is completed. Thus additional hydro capacity is not a feasible option for additional units.

Although Bangladesh has had some successes in small-scale development of renewable resources, they are peripheral to the issue of generating bulk electricity for the main grid. We have not found any renewable resource generating options likely to be economic for that purpose.

Table 1-6 summarizes the cost and performance characteristics for the selected generation technology options.

Section 1 Executive Summary

Table 1-6 Generation Expansion Options

| | | | | | | | | Net Heat Rates at Grid, KCAL/KWH | | O&M Cost |

Unit Type | Net Unit Capacity (At Grid) | Thermal Parameters | Equipment Cost $/kW | Installation Cost $/kW | Total Project Cost $/kW | Construc-tion Time Per Unit, Months | Plant Life, Years | Minimum Load, % of Capacity | At 100% Power | At 75% Power | At 50% Power | Weeks/year Sched Maint | FOR, % | Fixed $/kW-month | Vari-able $/MWH |

Steam (coal) with FGD | 300 | Note 1 | 1,097 | 269 | 1,366 | 60 | 30 | 50% | 2,173 | 2,217 | 2,287 | 8 | 8% | 0.58 | 1.80 |

Steam (coal) with FGD | 500 | Note 1 | 896 | 215 | 1,111 | 60 | 30 | 50% | 2,154 | 2,198 | 2,268 | 8 | 8% | 0.58 | 1.80 |

CC (natural gas) | 300 | Dual Pressure | 438 | 232 | 670 | 36 | 25 | 50% | 1,720 | 1,856 | 2,023 | 6 | 6% | 0.42 | 2.00 |

CC (natural gas) | 450 | Triple Pressure | 361 | 232 | 593 | 36 | 25 | 50% | 1,686 | 1,819 | 1,984 | 6 | 6% | 0.38 | 1.80 |

CC (natural gas) | 700 | Triple Pressure | 322 | 180 | 502 | 36 | 25 | 50% | 1,564 | 1,688 | 1,840 | 6 | 6% | 0.38 | 1.80 |

SCGT (natural gas) | 100 | | 238 | 163 | 401 | 24 | 20 | 50% | 2,687 | 2,986 | 3,161 | 4 | 4% | 0.42 | 2.50 |

SCGT (natural gas) | 150 | | 227 | 122 | 349 | 24 | 20 | 50% | 2,605 | 2,894 | 3,064 | 4 | 4% | 0.42 | 2.50 |

Steam (natural gas) | 300 | Note 1 | 711 | 263 | 974 | 60 | 30 | 50% | 2,127 | 2,171 | 2,239 | 6 | 6% | 0.58 | 1.60 |

Steam (natural gas) | 500 | Note 1 | 579 | 211 | 789 | 60 | 30 | 50% | 2,109 | 2,152 | 2,220 | 6 | 6% | 0.58 | 1.60 |

Nuclear (light water reactor) | 500 | Note 2 | 1,739 | 978 | 2,717 | 60 | 40 | 50% | 2,598 | 2,651 | 2,735 | 6 | 8% | 1.67 | 0.50 |

Diesel (diesel fuel) | 10 | Medium Speed | | | 450 | 24 | 15 | 50% | 2,900 | 3,050 | 3,200 | 3 | 15% | 0.83 | 3.00 |

| | | | | | | | | | | | | | | |

Note 1: Superheat, Single Reheat, 165 bar/538 deg C/538 deg C | | | | | | | | | |

Note 2: Saturated, Steam Reheat, 73 bar/293 deg C | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

1.3.4.2 Transmission

For transmission options, the focus is on amount of power to transfer, distance to transfer, and the continuing reliability of the interconnected system. In broad strokes, it is possible to assess what transmission options should be considered by conducting network analyses of far future or horizon year conditions. For instance, by identifying major pockets of load and how demand growth will be supplied to each load pocket, it is possible to determine the voltage level for future transmission expansion. Based on the analysis, 750 KV development is far beyond the needed capacity, while 132 KV will require many circuits to support the future growth of Dhaka. Hence, the transmission options are 230 KV and 400 KV for future supply of the Dhaka region.

For the Master Plan study, the expansion options comprise:

- 400 KV AC lines: 4x795 MCM ACSR conductors per phase

- 230 KV AC lines: 2x795 MCM AAAC conductors per phase

- 132 KV AC lines: 636 MCM AAAC conductor per phase

For congested urban areas such as Dhaka, where new right-of-way might be difficult or impossible to obtain, voltage uprating is a potential development option. In this option, the existing 132 KV line is retained, with modifications to allow for operation at 230 KV. In practice, the feasibility of the uprate will depend on specific characteristics of each uprated line. For planning purposes, we assume that the uprate is feasible. If it does turn out to be infeasible, the alternative is to replace the existing 132 KV line with a new 230 KV line on the same right-of-way. There is an additional cost impact to this that would need to be considered at time of implementation.

The options above did not include others that might be considered in a similar Master Plan study for specific reasons.

- High-voltage DC lines. The terminal costs for these lines tend to be relatively high, and thus these lines are economically viable where the application is for distances of 200 KM or more for transfers of 1,000 MW or more.

- Other voltage levels such 500 or 345 KV. The typical approach is to double the voltage level to take advantage of economies of scale. However, at 500 KV, we would have more capacity than needed for the horizon year, and at 345 KV, not enough capacity. The 400 KV level was a reasonable choice for next voltage level to include amongst the options.

For transformers, we aimed to standardize future additions to the following sizes:

- For 230/132 KV transformers: 225/225 MVA comprising of 3 single-phase units

- For 400/230 KV transformers: 375/375 MVA comprising of 3 single-phase units

Where existing transformers of different capacity were at the substations, we considered as an option adding future transformers of same capacity as the existing units. This is to avoid loading imbalance and circulating currents on the transformers when they operate in parallel.

1.3.4.3 Generation Sites

We selected thermal power plant sites based on a number of factors, including:

- Proximity to the load centers and their forecast load demand.

- Transmission to the load centers.

- Availability of adequate space at the site.

- The value of the land for other uses.

- The suitability of the ground and geotechnical conditions for construction of the plant.

- The possibility of flooding or seismic events.

- Potential sources of cooling water and makeup water.

- Fuel deliverability at the site.

- The impact of the facility in a positive or negative manner on the local environment.

- Sources of fill and construction materials.

- Access to the site for transportation of heavy equipments and construction materials.

- Availability of social facilities near site.

We established site rankings based on consideration of the above factors. Using these factors, we identified sites capable of accommodating the capacity of all committed and planned new units, a total of 20,495 MW. The generation planning process described in Section 6 provided the timing, technology, and size of the new units for the Base Case. We placed the units determined by that process at the sites listed in Table 1-7.

Table 1-7 Sites and Capacity Additions

Plant (Com = Committed) | Region | Unit Type | Unit # | Actual Year of Operation | Fuel | Net Capac, MW |

Gorasal Unit 1 Com (Under Maintenance) | Dhaka | ST | 1 | 2005 | Gas | 37 |

Tongi Com | Dhaka | CT | 1 | 2005 | Gas | 104 |

Sidhirganj Com | Dhaka | ST | 1 | 2005 | Gas | 197 |

Mymenshing RPC Com (CC Conv) | Central | ST/CC | 1 | 2006 | Gas | 70 |

Barapukuria Coal Com | Northern | ST | 1 | 2006 | Dom Coal | 115 |

Barapukuria Coal Com | Northern | ST | 2 | 2006 | Dom Coal | 115 |

Baghabari Barge Mtd Com (CC Conv) | Northern | ST/CC | 1 | 2006 | Gas | 40 |

Sidhirganj Com | Dhaka | CT | 1 | 2007 | Gas | 119 |

Sidhirganj Com | Dhaka | CT | 2 | 2007 | Gas | 119 |

Sidhirganj Com | Dhaka | CT | 3 | 2007 | Gas | 119 |

Sylhet Com | Central | CT | 1 | 2007 | Gas | 99 |

Chandpur Com | Southern | CC | 1 | 2007 | Gas | 99 |

Baghabari Barge Mtd Com | Northern | CC | 1 | 2007 | Gas | 130 |

Fenchuganj Com | Central | CC | 1 | 2008 | Gas | 88 |

Meghnaghat Com | Dhaka | CC | 1 | 2008 | Gas | 450 |

Sidhirganj Com | Dhaka | ST | 2 | 2009 | Gas | 197 |

Karnafuli Hydro HY2 Com | Southern | HY | 1 | 2009 | Hydro | 100 |

Khulna ST#2 Com | Western | ST | 2 | 2009 | Gas | 197 |

Siraganj Com | Northern | CC | 1 | 2009 | Gas | 450 |

Haripur | Dhaka | CC | 1 | 2008 | Gas | 150 |

Sikalbaha | Southern | CT | 1 | 2008 | Gas | 150 |

Bogra | Northern | CT | 1 | 2008 | Gas | 150 |

Bhola | Western | CC | 1 | 2008 | Gas | 150 |

Meghnaghat | Dhaka | CC | 2 | 2009 | Gas | 450 |

Khulna | Western | CT | 1 | 2009 | Gas | 100 |

Sikalbaha | Southern | CC | 1 | 2010 | Gas | 450 |

Meghnaghat | Dhaka | CC | 3 | 2011 | Gas | 450 |

Sylhet | Central | CT | 1 | 2011 | Gas | 150 |

Sirajganj | Northern | CC | 2 | 2012 | Gas | 450 |

Bheramara | Western | CC | 1 | 2012 | Gas | 450 |

Haripur | Dhaka | CT | 1 | 2013 | Gas | 150 |

Madanhat/New Sikalbaha | Southern | CC | 1 | 2013 | Gas | 450 |

Amibazar/Dhaka West | Dhaka | CC | 1 | 2014 | Gas | 450 |

Madanhat/New Sikalbaha | Southern | CC | 2 | 2014 | Gas | 450 |

Siddhirganj | Dhaka | CC | 1 | 2015 | Gas | 450 |

Shahjbazar | Central | CT | 1 | 2015 | Gas | 150 |

Khulna | Western | CC | 1 | 2015 | Gas | 450 |

Amibazar/Dhaka West | Dhaka | CC | 2 | 2016 | Gas | 450 |

Rajshanj | Northern | CC | 1 | 2016 | Gas | 450 |

Ashuganj | Dhaka | CT | 1 | 2017 | Gas | 150 |

Amibazar/Dhaka West | Dhaka | CT | 1 | 2017 | Gas | 150 |

Sylhet | Central | CT | 2 | 2017 | Gas | 150 |

Mymensingh New Site | Central | CT | 1 | 2017 | Gas | 150 |

Madanhat/New Sikalbaha | Southern | CT | 1 | 2017 | Gas | 150 |

Meghnaghat New Site | Dhaka | CC | 1 | 2018 | Gas | 700 |

Plant (Com = Committed) | Region | Unit Type | Unit # | Actual Year of Operation | Fuel | Net Capac, MW |

Madanhat/New Sikalbaha | Southern | CT | 2 | 2018 | Gas | 150 |

Saidpur | Northern | CT | 1 | 2018 | Gas | 150 |

Mawa | Dhaka | CC | 1 | 2019 | Gas | 700 |

Fenchuganj | Central | CT | 1 | 2019 | Gas | 150 |

Mymensingh New Site | Central | CT | 2 | 2019 | Gas | 150 |

Feni | Southern | CT | 1 | 2019 | Gas | 150 |

Meghnaghat New Site | Dhaka | CC | 2 | 2020 | Gas | 700 |

Madanhat/New Sikalbaha | Southern | CC | 1 | 2020 | Gas | 700 |

Amibazar/Dhaka West | Dhaka | CT | 2 | 2021 | Gas | 150 |

Mawa | Dhaka | CC | 2 | 2021 | Gas | 700 |

Baghabari | Northern | CT | 1 | 2021 | Gas | 150 |

Barisal | Western | CT | 1 | 2021 | Gas | 150 |

Mawa | Dhaka | CC | 3 | 2022 | Gas | 700 |

Madanhat/New Sikalbaha | Southern | CC | 2 | 2022 | Gas | 700 |

Mawa | Dhaka | CC | 4 | 2023 | Gas | 700 |

Khulna New | Western | CC | 1 | 2023 | Gas | 700 |

Khulna New | Western | CT | 1 | 2023 | Gas | 150 |

Ghorasal | Dhaka | CC | 1 | 2024 | Gas | 700 |

Khulna New | Western | CC | 2 | 2024 | Gas | 700 |

Ashuganj | Dhaka | CC | 1 | 2025 | Gas | 700 |

Fenchuganj | Central | CT | 2 | 2025 | Gas | 150 |

Baghabari | Northern | CT | 2 | 2025 | Gas | 150 |

Rangpur | Northern | CT | 1 | 2025 | Gas | 150 |

Bheramara | Western | CT | 1 | 2025 | Gas | 150 |

Total | | | | | | 20,495 |

1.3.5 Generation Expansion Plan (Section 6)

Our overall objective is to develop a least-cost generation expansion plan for the Bangladeshi power system covering the period 2005-2025. The generation expansion plan identifies the size, technology, fuel, and timing for new generating plants. The process of establishing the plan also permits development of large data sets tabulating the costs, fuel use, reliability, and other factors useful in analyzing issues relevant to decision-making.

Several sub-objectives support that overall objective.

- Establish a base case scenario and corresponding generation expansion plan for mid-range or most likely conditions. This provides a reference point for further analysis.

- Evaluate the impact of changes to base case conditions through development of a set of scenarios. If the resource plans for different cases are similar over a range of conditions in input variables such as demand or fuel price, one can have more confidence in starting with implementation of the base case plan. Changing conditions are less likely to mandate changes to the resource plan that would be too disruptive or costly. Furthermore, evaluating scenarios can also demonstrate the costs or benefits and other consequences of making choices in areas where choices are possible, such as fuel type.

- Determine the value of the energy and capacity supplied by generation options to establish an upper limit on what should be paid to construct and operate them. Where the cost, in particular the construction or fuel cost, of a generation option is especially uncertain, it can be extremely useful to determine the value of the

energy and capacity provided by that option. This is accomplished by calculating the cost of replacing those services, which often can be easily done with the analytical tools used for generation planning. This replacement cost is an upper limit on what should be paid (using least-cost principles) to construct and operate the option. The option need not be a power plant – it could be a DSM program, a capacity and energy purchase, a program to improve existing plants, or others.

The general approach is to insert a plant with similar operating characteristics to the option of interest, but with zero capital, fuel, and O&M costs. Compared to the Base Case, this “free” plant will reduce the need for other new units and will reduce capital, fuel, and O&M costs. The amount of the overall cost reduction is the potential value to the system of the option of interest.

We used two complementary kinds of analysis. The starting point for both of them is comprehensive data about Bangladesh’s power system, including the costs and performance of existing and potential new generating units.

The first part of the analysis used screening curves. The method consists of developing generation cost curves that show the type of unit that is most economical at each capacity factor. Screening curves plot the annual total cost of electricity from a unit over the range of capacity factors from 0% to 100%. One type might be most economical at low capacity factors and would be most suitable for peaking duty. Another might be most economical at high capacity factors and would be most suitable for base load duty. The curves provide a convenient initial comparison of different technology and fuel types.

The second part of the analysis used a sophisticated computer program for power system optimization and simulation to develop optimal generation expansion plans for the Bangladeshi power system. Based on extensive inputs about the existing system, future conditions, and characteristics of candidate technologies for generation expansion (new power plants), the optimization program provides answers on the type, size, and timing of plant additions during the planning period. The goal is to install new generation capacity on an economic basis while maintaining system reliability. The difference from the screening curve analysis is that in this analysis the technology type and capacity decisions also depend on the size of the units relative to the existing power system, how the new units are to be operated among the existing generating units, the optimal level of reliability, and on the future load growth.

We developed the Base Case scenario and corresponding generation expansion plan based on mid-range or most likely conditions to provide a reference point for further analysis. We defined several scenarios to investigate the impact of changes to Base Case conditions through the use of production simulation and system optimization.

- High and low demand growth rates.

- Limited gas availability, leading to a need for plants using coal fuel.

- High and low cost of energy not served.

- High and low discount rates.

- No application of the LOLP criterion in resource planning.

We defined two scenarios to estimate the value of potential new resources.

- A new 500 MW base load power unit.

- A new 1,000 MW interconnection to neighboring countries providing energy equivalent to a 50% capacity factor.

In addition, we studied some scenarios using screening analysis exclusively or in part.

- Unit size of different technologies.

- Peaking and base load technologies

- Nuclear and diesel units.

- Use of natural gas in steam units.

- High and low gas prices.

- Breakeven price of coal.

- Unit cost of energy not served.

1.3.5.2 Screening Analysis Results

The key screening analysis results are shown in 31-2. The least cost curve consists of ENS for capacity factors from zero to about 2% , the 150 MW SCGT from 2% to about 15%, and the 700 MW CC above 15%. For the first few years we assume the 700 MW CC will not be used. During that time the least cost curve includes the 150 MW SCGT from 2% to about 25% capacity factors and the 450 MW CC above 25%. The steam technologies and the diesel unit are not very close to competitive at any capacity factor.

Figure 1-3 All Technologies and Least Cost Curve

1.3.5.3 Base Case Results

Table 1-8 shows Base Case production simulation and system optimization results for resource additions and reliability statistics. Table 1-9 shows the corresponding costs. Figure 1-4 shows the fuel requirements.

Table 1-8 Base Case Unit Additions and System Reliability Indices

| | Unit Additions, Number of Units | | System Reliabilty Indices |

Year | Peak Load, MW | 700 MW CC | 450 MW CC | 150 MW SCGT | Installed Capacity, MW | LOLP, % | ENS, GWH | Reserve Margin, % |

2005 | 4,308 | 0 | 0 | 0 | 4,458 | 8.138 | 180.8 | 3% |

2006 | 4,693 | 0 | 0 | 0 | 4,683 | 10.884 | 320.9 | 0% |

2007 | 5,112 | 0 | 0 | 0 | 5,425 | 6.350 | 137.5 | 6% |

2008 | 5,569 | 0 | 0 | 2 | 6,002 | 5.135 | 108.3 | 8% |

2009 | 6,066 | 0 | 1 | 0 | 7,313 | 0.845 | 8.9 | 21% |

2010 | 6,608 | 0 | 2 | 0 | 7,986 | 0.750 | 8.2 | 21% |

2011 | 7,148 | 0 | 1 | 1 | 8,586 | 0.797 | 9.0 | 20% |

2012 | 7,732 | 0 | 2 | 0 | 9,449 | 0.490 | 5.1 | 22% |

2013 | 8,364 | 0 | 1 | 1 | 9,979 | 0.834 | 10.1 | 19% |

2014 | 9,047 | 0 | 2 | 0 | 10,879 | 0.654 | 7.4 | 20% |

2015 | 9,786 | 0 | 2 | 1 | 11,579 | 0.937 | 12.6 | 18% |

2016 | 10,512 | 0 | 2 | 0 | 12,479 | 0.848 | 11.2 | 19% |

2017 | 11,291 | 0 | 0 | 5 | 13,229 | 0.997 | 13.5 | 17% |

2018 | 12,128 | 1 | 0 | 2 | 14,229 | 0.912 | 12.2 | 17% |

2019 | 13,027 | 1 | 0 | 3 | 15,243 | 0.880 | 11.9 | 17% |

2020 | 13,993 | 2 | 0 | 0 | 16,643 | 0.578 | 6.7 | 19% |

2021 | 14,924 | 1 | 0 | 3 | 17,455 | 0.816 | 11.2 | 17% |

2022 | 15,917 | 2 | 0 | 0 | 18,526 | 0.949 | 15.6 | 16% |

2023 | 16,977 | 2 | 0 | 1 | 19,867 | 0.811 | 12.5 | 17% |

2024 | 18,107 | 2 | 0 | 0 | 21,070 | 0.923 | 15.9 | 16% |

2025 | 19,312 | 1 | 0 | 4 | 22,370 | 0.950 | 16.1 | 16% |

| Total | 12 | 13 | 23 | 48 | | | |

| Total MW | 8,400 | 5,850 | 3,450 | 17,700 | | | |

| Percent | 47% | 33% | 19% | ^ Total Units and MW Added | |

Table 1-9 Base Case System Costs

| All Costs in Millions of 2005 US$ |

Year | Operating Costs | Capital Costs | Total Direct Costs | ENS Costs | Total Costs |

Fixed & Variable O&M | Fuel |

2005 | 124 | 702 | 0 | 826 | 78 | 904 |

2006 | 138 | 738 | 63 | 938 | 138 | 1,076 |

2007 | 157 | 811 | 305 | 1,273 | 59 | 1,332 |

2008 | 161 | 867 | 478 | 1,506 | 47 | 1,552 |

2009 | 180 | 924 | 467 | 1,570 | 4 | 1,574 |

2010 | 185 | 964 | 518 | 1,667 | 4 | 1,670 |

2011 | 193 | 1,036 | 467 | 1,696 | 4 | 1,700 |

2012 | 202 | 1,101 | 546 | 1,849 | 2 | 1,851 |

2013 | 210 | 1,177 | 636 | 2,023 | 4 | 2,028 |

2014 | 220 | 1,258 | 604 | 2,082 | 3 | 2,085 |

2015 | 232 | 1,347 | 349 | 1,928 | 5 | 1,933 |

2016 | 243 | 1,434 | 494 | 2,170 | 5 | 2,175 |

2017 | 256 | 1,569 | 576 | 2,401 | 6 | 2,407 |

2018 | 269 | 1,678 | 750 | 2,697 | 5 | 2,703 |

2019 | 273 | 1,583 | 645 | 2,501 | 5 | 2,506 |

2020 | 288 | 1,683 | 787 | 2,758 | 3 | 2,761 |

2021 | 294 | 1,767 | 832 | 2,893 | 5 | 2,898 |

2022 | 304 | 1,862 | 819 | 2,984 | 7 | 2,991 |

2023 | 316 | 1,968 | 589 | 2,874 | 5 | 2,879 |

2024 | 328 | 2,080 | 309 | 2,717 | 7 | 2,724 |

2025 | 346 | 2,210 | 0 | 2,556 | 7 | 2,563 |

Total | 4,916 | 28,758 | 10,236 | 43,910 | 402 | 44,313 |

Total NPV | 1,469 | 8,268 | 3,042 | 12,779 | 270 | 13,050 |

Figure 1-4 Base Case Fuel Use

1.3.5.4 Selected Results from High Demand, Low Demand, and Limited Gas Scenarios

Figure 1-5 compares total costs and natural gas use in the Base Case, High Demand, and Low Demand scenarios. The results are as expected. Costs and gas use are proportional to demand.

Figure 1-6 compares the total costs for the Base Case and Limited Gas scenarios. The coal plants in the Limited Gas scenario have higher capital and lower operating costs than the combined cycles in the Base Case. The net impact is the cost of power from the coal plants is higher than for the combined cycles. The capital costs are all incurred before operation, so in the Limited Gas scenario the total costs far exceed those in the Base Case while the plants are being built. As more coal plants become operational, their operating cost advantage brings the total cost back about equal to the Base Case by the end of the study period.

Figure 1-7 shows fuel use in the Limited Gas scenario and compares natural gas use to that in the Base Case. As one would expect, gas use falls off in the Limited Gas scenario, while the use of coal increases dramatically.

Figure 1-5 Comparison of Costs and Natural Gas Use for Demand Growth Cases

Figure 1-6 Comparison of Total Costs, Base Case vs. Limited Gas Case

Figure 1-7 Fuel Use in Limited Gas Case vs. Base Case Natural Gas Use

Analysis of Base Case and the other scenarios we studied produced the following conclusions:

Base Case

- The optimal mix of new resources is fueled by natural gas, with about 20% of new MW coming from SCGT units and 80% from CC units.

- Reliability is low in 2005 – 2007 because there is not enough time to install any units other than the committed units under way.

- Total costs, including the operating costs of the existing system and committed units, and all costs of new units, are about $1.5 billion in 2008 and increase to as much as $3 billion in later years.

- Fuel costs amount to more than 60% of total costs.

- Natural gas requirements grow from 225 BSCF in 2005 to over 700 BCSF in later years.

- The optimal mix of new resources does not change significantly.

- Costs and fuel requirements follow the same trend as demand.

- The optimal mix of new resources includes steam plants fueled by both domestic and imported coal when natural gas is assumed to be unavailable.

- Costs increase significantly when natural gas is not available.

High and Low Demand Scenarios

Limited Gas

- Natural gas requirements fall, offset by large increases in the use of both domestic and imported coal.

- High and low discount rates have very little effect on the optimal resource plan, costs, or fuel requirements.

- When the LOLP criterion is applied, high and low cost of ENS have very little effect on the optimal resource plan, costs, or fuel requirements.

- When the LOLP criterion is not applied, the optimal resource plan changes.

High and Low Discount Rates

High and Low Cost of ENS

No Application of LOLP Criterion

− Fewer MW of new units are added, and SCGT form a larger percentage of the mix.

− The optimal resource plans all have lower reserve margins and higher LOLP and ENS than the Base Case.

− The lower the unit cost of ENS, the higher the LOLP and amounts of ENS, and the lower the reserve margin.

- The application of the LOLP criterion leads to higher overall system costs, given the values for the other parameters we are using.

- The application of the LOLP criterion has little effect on fuel requirements.

Value Scenarios

To calculate the value of a potential new resource, we insert it in the resource plan with zero capital, fuel, and O&M costs. We then calculate the costs of building and operating the generation system when this zero-cost plant is included. Compared to the Base Case, this “free” plant will reduce the need for other new units and will reduce capital, fuel, and O&M costs. The amount of the overall cost reduction is the potential value to the system of the option of interest.

New 500 MW Generating Unit

- The new unit has value close to the costs associated with the unit it replaces, a 450 MW gas fueled CC operating at about 75% capacity factor.

- The new unit’s operating value is $24/MWH. Its total value is $38/MWH assuming operation at about 75% capacity factor.

New 1,000 MW Interconnection

- The new interconnection has value close to the costs associated with the units it replaces, two 450 MW gas fueled CC operating at about 50% capacity factor.

- The new interconnection’s operating value is $24/MWH. Its total value is

$45/MWH assuming operation at about 50% capacity factor.

1.3.6 Transmission Expansion Plan (Section 7)

In the process of conducting the transmission studies for the Master Plan the first step consisted of establishing reliability criteria to be used in the study. The criteria were developed and presented to PGCB and Power Cell planning staff for discussion.

The horizon year planning approach was used to conduct the transmission studies. Here, following definition of the Base Case transmission configuration, which for this study is 2010, the subsequent study involved development of transmission alternatives for the horizon year 2025. The horizon year offers the best opportunities for optimization and affects the development of the transmission system in the intermediate years.

Initially load flow and contingency analysis were conducted to develop the transmission plan in the horizon year. Short circuit and stability analysis were conducted to determine the fault current levels and the dynamic response of the 2025 plan.

Subsequently, we conducted staging, which is the process of determining when each of the components of the horizon year plan is needed to meet planning criteria. This identified the staging of transmission projects in five year increments starting from 2010.

Finally, the robustness of the Master Plan was tested via sensitivity studies that looked into alternate dispatches that could impose local stresses on the transmission network. These studies led to the identification of additional transmission projects to address specific conditions in the future, and thus improved the plan’s robustness. A by-product of the studies is the identification of must-run generators that are required in intermediate years to meet reliability criteria.

The Master Plan is presented in a detailed discussion of transmission lines, transformers and shunt compensation included in the plan, in five year increments from 2010, 2015, 2020, and 2025.

1.3.7 Economic and Financial Analysis (Section 8)

The TOR’s component B, Task 3 (vi) requires the consultant to “Assist BPDB, PGCB, and PMU to prepare financial projections up to the year 2025, with emphasis on cash flows for the recommended power system expansion plan, and conduct economic analyses to determine if the proposed development program is justified.”